Method 1: Planon default

No Grouping (directly & indirectly chargeable areas)

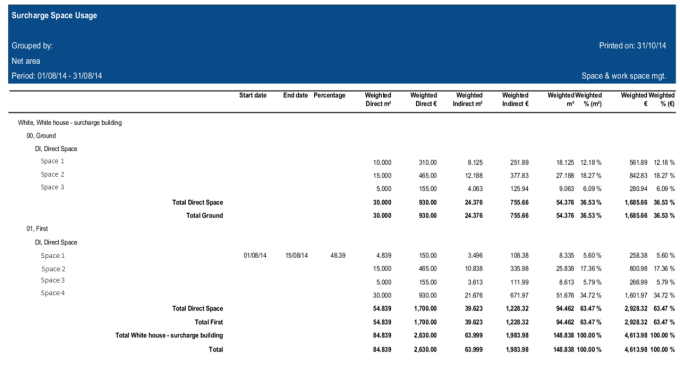

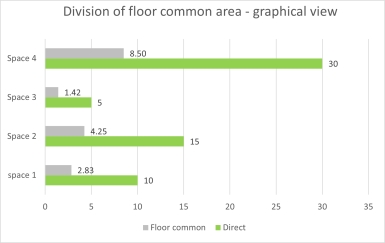

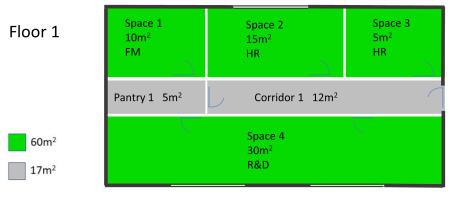

In this example directly and indirectly chargeable areas are included in the report while no grouping is applied. The Weighed direct m2 are reported 1:1. The Weighed indirect m2 are a combination of common floor area and common building area. In these images you can see how the common floor areas and common building areas are assigned to the directly chargeable spaces on floor 1.

Division of floor common area

Space 1 | Direct | 10 | 10 |

Floor common | (10/60)*17 | 2.83 | |

total | 12.83 | ||

Space 2 | Direct | 15 | 15 |

Floor common | (15/60)*17 | 4.25 | |

total | 19.25 | ||

Space 3 | Direct | 5 | 5 |

Floor common | (5/60)*17 | 1.42 | |

total | 6.42 | ||

Space 4 | Direct | 30 | 30 |

Floor common | (30/60)*17 | 8.50 | |

total | 38.50 |

The end result is that each directly chargeable space gets some additional indirectly chargeable m2 from pantry, corridor and reception.

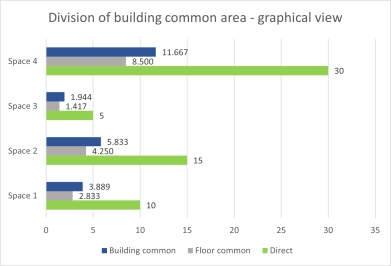

Division of building common area

Space 1 | Direct | 10 | 10 |

Floor common | (10/60)*17 | 2.833 | |

Building common | (10/90)*35 | 3.889 | |

total | 16.722 | ||

Space 2 | Direct | 15 | 15 |

Floor common | (15/60)*17 | 4.250 | |

Building common | (15/90)*35 | 5.833 | |

total | 25.083 | ||

Space 3 | Direct | 5 | 5 |

Floor common | (5/60)*17 | 1.417 | |

Building common | (5/90)*35 | 1.944 | |

total | 8.361 | ||

Space 4 | Direct | 30 | 30 |

Floor common | (30/60)*17 | 8.500 | |

Building common | (30/90)*35 | 11.667 | |

total | 50.167 |

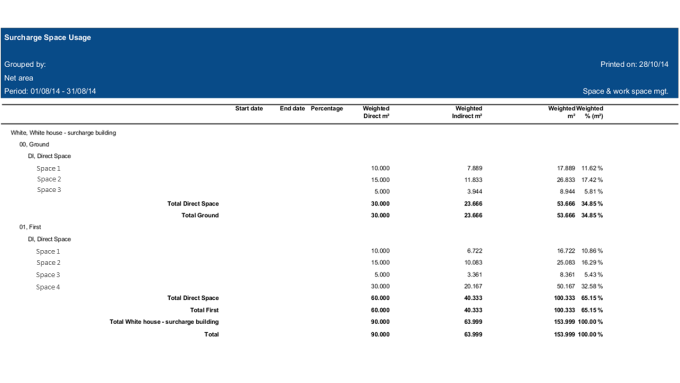

Overview of calculations for the indirectly chargeable spaces

| |

Space 1 (Purchase) | • (12 m2 of Corridor 0): (10 / 30 (=direct m2 on Floor 0)) x 12 = 4.0 m2 • (35 m2 of Reception): (10 / 90 (=direct m2 of Total building)) x 35 = 3.889 = 4.0 + 3.889 = 7.889 |

Space 2 (Sales) | • (12 m2 of Corridor 0): (15 / 30 (=direct m2 on Floor 0)) x 12 = 6.0 m2 • (35 m2 of Reception): (15 / 90 (=direct m2 of Total building)) x 35 = 5.833 = 6.0 + 5.833 = 11.833 |

Space 3 (Sales) | • (12 m2 of Corridor 0): (5 / 30 (=direct m2 on Floor 0)) x 12 = 2.0 m2 • (35 m2 of Reception): (5 / 90 (=direct m2 of Total building)) x 35 = 1.944 = 2.0 + 1.944 = 3.944 |

| |

Space 4 (FM) | • (17 m2 of Pantry 1 + Corridor 1): (10 / 60 (=direct m2 on Floor 1)) x 17 = 2.833 m2 • (35 m2 of Reception): (10 / 90 (=direct m2 of Total building)) x 35 = 3.889 = 2.833 + 3.889 = 6.722 |

Space 5 (HR) | • (17 m2 of Pantry 1 + Corridor 1): (15 / 60 (=direct m2 on Floor 1)) x 17 = 4.25 m2 • (35 m2 of Reception): (15 / 90 (=direct m2 of Total building)) x 35 = 5.833 = 4.25 + 5.833 = 10.083 |

Space 6 (HR) | • (17 m2 of Pantry 1 + Corridor 1): (5 / 60 (=direct m2 on Floor 1)) x 17 = 1.417 m2 • (17 m2 of Pantry 1 + Corridor 1): (5 / 60 (=direct m2 on Floor 1)) x 17 = 1.417 m2 = 1.417 + 1.944 = 3.361 |

Space 7 (R&D) | • (17 m2 of Pantry 1 + Corridor 1): (30 / 60 (=direct m2 on Floor 1)) x 17 = 8.5 m2 • (35 m2 of Reception): (30/90 (=direct m2 of Total building)) x 35 = 11.667 = 8.5 + 11.667 = 20.167 |

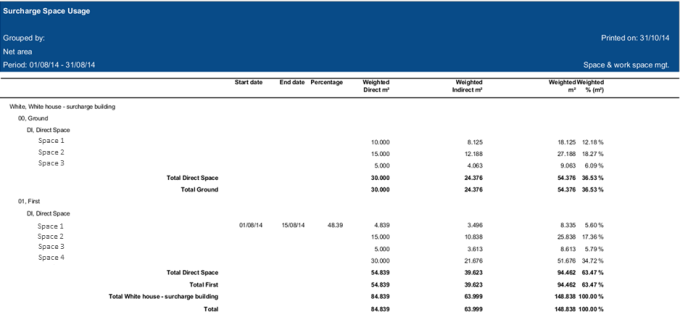

No Grouping (direct & indirect area) – partial usage in reporting period

This example gives information on how directly and indirectly chargeable areas are reported while no grouping is applied.

Space 1 is only used between 1-8-2014 and 15-8-2014. The calculation takes this limited period into account. That is (15 days / 31 days (reporting period)) x 10 m2 = 4.839 m2. This also means that the entire building is weighted at 80+4.839=84.839 direct m2 and the floor 1 is weighted at 50+4.839=54.839 direct m2.

The calculations and results are shown in this table.

Space 2 | • (17 m2 of Pantry 1 + Corridor 1): (4.839 / 54.839 (=direct m2 on Floor 1)) x 17 = 1.50 m2 • (35 m2 of Reception): (4.839 / 84.839 (=direct m2 of Total building)) x 35 = 1.996 = 1.50 + 1.996 = 3.496 |

Space 1 | • (12 m2 of Corridor 0): (10 / 30(=direct m2 on Floor 0)) x 12 = 4.0 m2 • (35 m2 of Reception): (10 / 84.839 (= direct m2 of Total building)) x 35 = 4.125 = 4.0 + 4.109 = 8.125 |

This report helps you to understand the calculations.

See the start date and end date of Space1. |

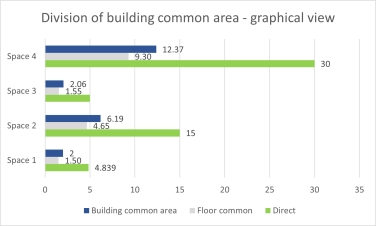

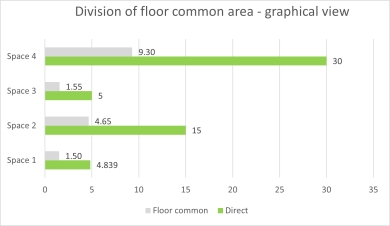

In the following illustrations, you will see how the common floor areas and common building areas are assigned to the directly chargeable spaces on Floor 1.

Division of building common area

(15d/31d)*10 m2 = 4.839 m2 | |||

Space 1 | Direct | 10 | 10 |

Floor common | (10/60)*17 | 2.833 | |

Building common | (10/90)*35 | 3.889 | |

total | 16.722 | ||

Space 2 | Direct | 15 | 15 |

Floor common | (15/60)*17 | 4.250 | |

Building common | (15/90)*35 | 5.833 | |

total | 25.083 | ||

Space 3 | Direct | 5 | 5 |

Floor common | (5/60)*17 | 1.417 | |

Building common | (5/90)*35 | 1.944 | |

total | 8.361 | ||

Space 4 | Direct | 30 | 30 |

Floor common | (30/60)*17 | 8.500 | |

Building common | (30/90)*35 | 11.667 | |

total | 50.167 | ||

Division of floor common area

(15d/31d)*10 m2 = 4.839 m2 | |||

Space 1 | Direct | 4.839 | 4.839 |

Floor common | (4.839/54.839)*17 | 1.50 | |

total | 6.34 | ||

Space 2 | Direct | 15 | 15 |

Floor common | (15/54.839)*17 | 4.65 | |

total | 19.65 | ||

Space 3 | Direct | 5 | 5 |

Floor common | (5/54.839)*17 | 1.55 | |

total | 6.55 | ||

Space 4 | Direct | 30 | 30 |

Floor common | (30/54.839)*17 | 9.30 | |

total | 39.30 | ||

No Grouping (direct & indirect area) – partial usage during reported period + money

This report includes directly and indirectly chargeable areas that are reported while no grouping is applied. All space usage (directly and indirectly chargeable spaces) are linked to a tariff group that costs € 1 per m2 per day. In the report options, the option to display the costs also is switched on. As the reported period is 31 days (1-8-2014 to 31-8-2014), you can compare this report with the previous one, the only difference being that you have to multiply all values by 31 for the costs columns.