Accounting commitment data fields

• The accounting commitments fields for the functional currency have the prefix "FC". • Functional currency functionality for cashback is currently not supported.(*). |

Field | Description | ||

|---|---|---|---|

Accounting commitment type | Displays the accounting commitment type. | ||

Accounting standard | Displays the Accounting standard based on which the accounting commitments are generated. | ||

Accumulated depreciation / FC - accumulated depreciation | Displays the accumulated depreciation on the right-of use. | ||

Cashback at start of period / *FC - cashback at start of period | Displays the discounted value of cashback at the start of the accounting period.

| ||

Cashback at end of period / *FC - cashback at end of period | Displays the discounted value of the cashback at the end of the accounting period. This value is calculated as follows: Cashback at start + Cashback interest - Cashback return | ||

Cashback payment / *FC - cashback payment | Displays the cashback return. This value is calculated as follows: Lease amount * (1 - factor) | ||

Cashback interest / *FC - cashback interest | Displays the cashback interest. This value is calculated as follows: Cashback at start * Discount rate | ||

Cashback - Factor | Displays the factor that is used: (Lease Liability at start of the lease – Cashback at start of the lease) / Lease liability at start of the lease) | ||

Change in right of use / FC- Change in right of use | Displays the change in the right-of-use at the end of the sublease (after you changed the amount on a headlease). | ||

Closure date | Displays the closure date of the accounting commitment. This date is always equal to the end date of the accounting period. | ||

Contract line | Displays the contract line based on which the accounting commitments are generated. | ||

Depreciation / FC - depreciation | Displays the decreasing value of the property based on the valuation of the property and time period. This is only displayed for finance lease. Even though a contract line is terminated early, the depreciation will still be booked until the end of the original contract line / economic life span. For a contract line based on finance lease, if the contract is for the lessor, depreciation will not be calculated. The lessee is expected to depreciate an asset. | ||

Depreciation loss / FC - depreciation loss | Displays the deprecation loss at the end of the sublease (after you changed the amount on a headlease). | ||

End date | Displays the end date of the accounting commitment. | ||

Exchange rate functional currency | Displays the exchange rate that is used to calculate the functional currency. For more information on functional currencies, see Using functional currencies. | ||

Interest / FC - interest | Displays the rate of interest defined on the contract line. | ||

Financial commitment details | This field provides information about the linked supplements. | ||

Forex - gain / loss FX gain/loss lease amount Forex - long-term gain / loss Forex - short-term gain / loss | Displays the Forex – gain / loss. Planon registers the differences in spot rate and average rate as Forex – gain / loss. | ||

Net gain/loss FC - net gain/loss | Displays the gain / loss of a sublease at the start of this sublease. | ||

Gross lease amount / FC - gross lease amount | Displays the lease amount including lease incentive, initial direct costs and restoration costs. This field is used to calculate the depreciation for ASC 842 long-term operating leases. | ||

Gross lease receivable / FC - gross lease receivable | This field is used for headlease / sublease. It displays the part of the right-of-use that is transferred from the headlease to the sublease when entering into a sublease. At the end of the sublease, the right-of-use is transferred back to the headlease. For more information, see Registering a sublease. | ||

Lease amount / FC - lease amount | Displays the lease amount that has to be paid / received. | ||

Liability at start/end of period / FC - liability at start/end of period | Displays the liability amount at the start / end of the commitment period. | ||

Long-term liability at start/at end of period / FC - long-term liability at start/at end of period | The long-term liability at the start / end of the accounting period. | ||

Net movement / FC - net movement | Displays the difference in lease liability, which is the amount after the internal rate of return is deducted from the payment amount. This is only displayed for finance lease. | ||

Payment / FC - payment | Displays the payments in the accounting period for only the regular commitments, based on the closure date of the financial commitments (accounting commitment's start date <= financial commitments' closure date <= accounting commitment's end date). | ||

Payment? | Indicates if the amount specified is to be paid to or received from the other party. | ||

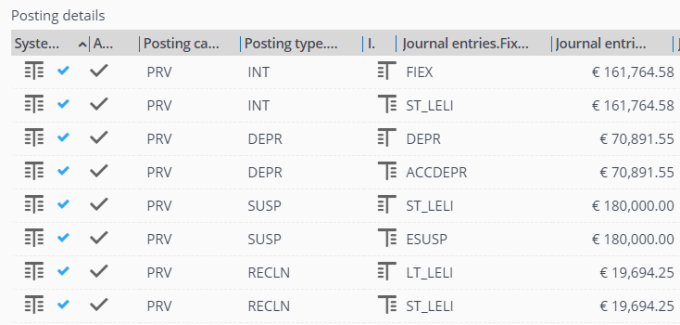

Posting details | Displays an overview of all relevant data of the postings/journal entries linked to the accounting commitment.

| ||

Reclassification to short-term / FC - reclassification to short term | Displays the liability that will be reclassified to 'short-term liability' when the time window shifts over time. | ||

Remainder / FC - remainder | Displays the difference between payment and deferred income/accrued expense. This is only displayed for operating lease and additional accounting commitments. | ||

Reversal? | This field is populated if there is a change with regard to a closed period. In this case, the accounting data can no longer be adjusted. Planon creates reversals for all the original entries and the changed commitments are recalculated. The entire set (reversals and corrected entries) is posted in the next month. | ||

Right of use at start / end FC - right of use at start / end | Displays the ROU amount at the start / end of the commitment period. | ||

Send to financial system? | Planon uses this field to indicate whether postings should be sent to your financial system. | ||

Short-term liability at start / end of period / FC - short-term liability at start / end of period | The short-term liability at the start / end of the accounting period. | ||

Start date | Displays the start date of the accounting commitment. | ||

Start date original period / End date original period | If an amount changes in a period that is already financially closed, this change is registered in the first open period. However, for reporting purposes it might be required to have a link to the original period as well. Planon automatically stores this information in the Start date original period / End date original period fields. | ||

Sublease end - RoU at start / at end / FC - Sublease end - RoU at start / at end | Displays the right-of-use at the start / at the end of the sublease. At the end of the sublease, the right-of-use must be transferred back to the headlease. Example: 20% of the headlease is subleased. At the start of the sublease, the right-of-use of the headlease was 1,000 and at the end of the sublease it was 400. The right-of-use at the start that is transferred to the sublease is 20% * 1,000 = 200. The right-of-use that must be transferred back to the headlease is: 20% * 400 = 80. | ||

Sublease end - RoU interest / FC- Sublease end - RoU interest | Displays the interest amount that is used to calculate the carrying value of the right-of-use at the end of the sublease. At the end of the sublease, the final carrying value is transferred back to the headlease. | ||

Type | Displays whether the contract line is based on Operating lease or Finance lease. |