Property

You can view and edit all relevant property data in a single screen.

1. Go to the Asset details page of the asset/property you wish to view or edit.

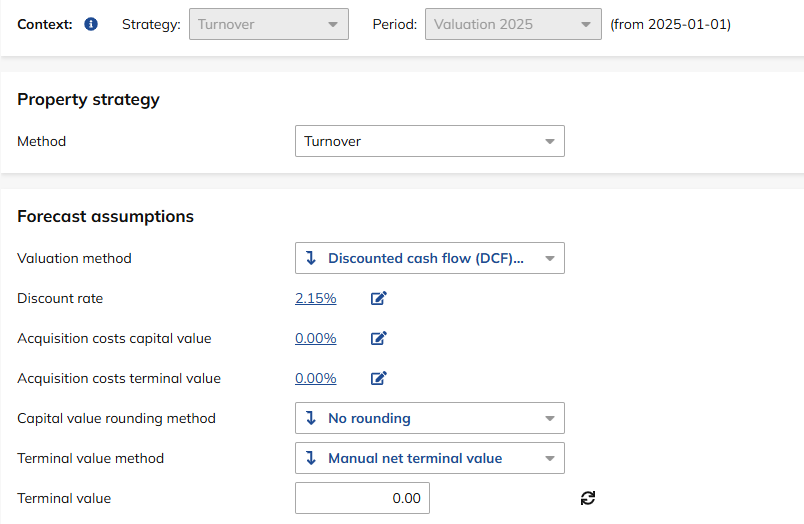

2. In the navigation panel, select Input > Property. The following input screen appears:

Field | Description | ||

|---|---|---|---|

Strategy | Displays the custom strategy when the strategies to be calculated are set to Custom strategy, and displays the system strategy (Highest Outcome, Privatization, Turnover) when the strategies to be calculated are set to System strategies. If Highest outcome is selected, both the Hold and Privatization strategies are calculated. The strategy with the highest net capital value is considered the highest strategy and will be used as the basis of value. | ||

Valuation method | Select the required valuation method from the drop-down list (Discounted cash flow method, Hardcore top-slice method). Please note that the valuation method is editable only when the process type is Valuation or External Valuation. For all other process types, the valuation method defaults to Discounted cash flow and cannot be modified. | ||

Discount rate | The discount rate is the rate used to discount forecasted cash flows. It reflects not only the time value of money but also the risks associated with the type of cash flow and the future operations of the asset. The discount rate is the sum of the following components: • Risk free rates: This is the default value for each country. The risk-free rate displayed is based on the country of the main asset and the valuation date. You can manually change this value; however, if you delete it, the default value will reappear. Please note that the default value cannot be deleted. • Market risk premium: This is the default value for each sector. The displayed Market risk premium is based on the sector of the main asset and the valuation date. You can manually change this value; however, if you delete it, the default value will reappear. Please note that the default value cannot be deleted. • Property risk premium: You can manually change this field; there is no default. | ||

Acquisition costs capital value | The Acquisition costs capital value is the total of the data fields displayed in the sliding panel. You can open the sliding panel by clicking on the percentage. The following fields are available for editing: • RETT: The default value is a calculated field based on the selected scheme in the RETT setting and the Gross Capital Value. You can manually provide a RETT; however, if it is deleted, the default value will be displayed again. Please note that the default value cannot be deleted. • VAT: The default value is a calculated field based on the selected scheme in the VAT setting and the Gross Capital Value. You can manually provide a VAT; however, if it is deleted, the default value will be displayed again. Please note that the default value cannot be deleted. • Notary costs: The default value is set at the company level. You can manually enter notary costs; however, if this value is deleted, the default value will be displayed again. Please note that the default value cannot be deleted. • Agent costs: The default value is set at the company level. You can manually enter agent costs; however, if this value is deleted, the default value will be displayed again. Please note that the default value cannot be deleted. | ||

Acquisition costs terminal value | The Acquisition costs terminal value is the total of the data fields displayed in the sliding panel. You can open the sliding panel by clicking on the percentage. The following fields are available for editing: • RETT: The default value is a calculated field based on the selected scheme in the RETT setting and the Gross Terminal Value. You can manually provide a RETT; however, if it is deleted, the default value will be displayed again. Please note that the default value cannot be deleted. • VAT: The default value is a calculated field based on the selected scheme in the VAT setting and the Gross Terminal Value. You can manually provide a VAT; however, if it is deleted, the default value will be displayed again. Please note that the default value cannot be deleted. • Notary costs: The default value is set at the company level. You can manually enter notary costs; however, if this value is deleted, the default value will be displayed again. Please note that the default value cannot be deleted. • Agent costs: The default value is set at the company level. You can manually enter agent costs; however, if this value is deleted, the default value will be displayed again. Please note that the default value cannot be deleted. | ||

Capital value rounding method | Select a rounding method from the drop-down list. The capital value rounding method determines how the net capital value of a property is rounded. A default value can be configured for each country and property type in the default settings. The default rounding method is set at the company level. You can manually select a different rounding method if needed. If the manually selected method is deleted, the default value will be restored. Note that the default value cannot be deleted. | ||

Entry value | The entry value method is used to calculate the Internal Rate of Return (IRR) of a property. A default value can be configured for each country and property type in the default settings. You can select a method to calculate the entry value. The available options are: • Market value net • Total investment • Book value net The entry value, calculated based on the selected method, will be displayed in the next column. If the process type is set to Valuation, the entry value will always be based on the Net capital value, and the field will not be visible.

| ||

Terminal value | Select a terminal value method from the drop-down list, then enter a value in the adjacent field. You can choose from the following terminal value methods: • Exit yield gross ERV • Exit yield gross PGI • Manual net terminal value • Percentage of VPV |