Hardcore top slice method

The Hardcore top slice method combines the hardcore value and top slice value for each rental contract to calculate the gross capital value. The hardcore value is the lowest risk income, capitalized into perpetuity. The top slice value depends on the rent status: for over-rented situations, it's the "froth" value, and for under-rented situations, it's the "layer" value. The sum of the hardcore, froth, and layer values gives the gross capital value. Adjustments for non-recurrent operational and capital expenditures are made to determine the net capital value, which subtracts purchaser's costs from the gross capital value.

To access the Hardcore top slice method screen:

1. Go to the Asset details page of the asset/property you wish to view or edit.

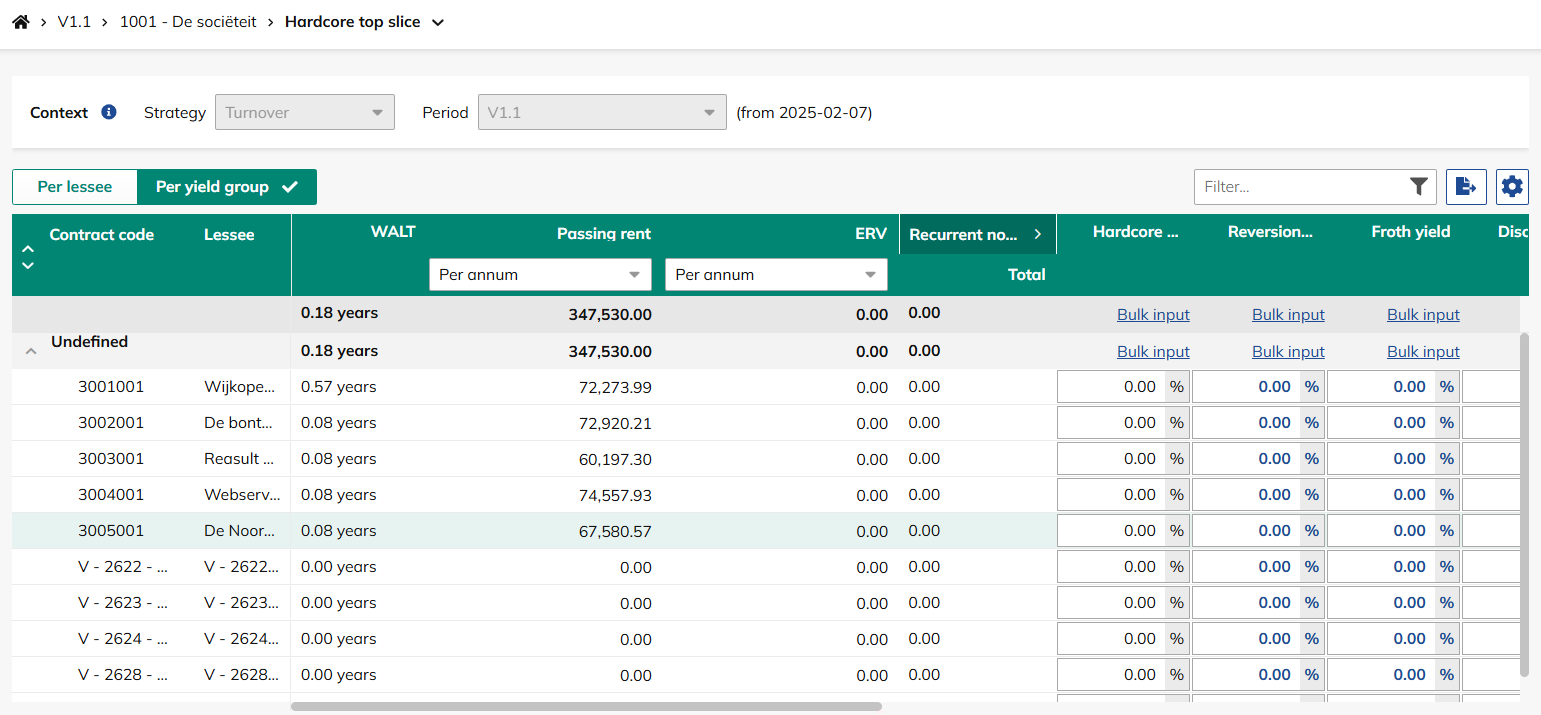

2. In the navigation panel, select Input > Hardcore top slice method. The following screen appears:

The Hardcore top slice screen has two views:

• Per lessee

• Per yield group

In this view, contracts are grouped together based on their yield group. The yield group is displayed as the first pinned column, and it cannot be edited. You can input the following values in bulk for this view:

◦ Hardcore yield

◦ Reversionary yield

◦ Froth yield

The table below lists the information available in the Hardcore top slice screen.

Column | Description |

|---|---|

Contract code | Read-only field that displays the unique contract code. |

Lessee | Read-only field that displays the lessee linked to the contract. |

Yield group | Here you can specify the yield group. |

WALT (Weighted Average Lease Term) | Read-only field that displays the average remaining lease term, weighted by the lease size. |

Passing rent | Read-only field that displays the current annual rental income. You can select one of the following calculation methods: • per annum/quarter/month/week • m2 NFA p.a. / p.q./ p.m. / p.w. • m2 GFA p.a. / p.q./ p.m. / p.w. • m2 ITZA p.a. / p.q./ p.m. / p.w. • per unit p.a. / p.q./ p.m. / p.w. |

ERV (Estimated Rental Value) | Read-only field that displays an estimate of the market rental value. You can select one of the following calculation methods: • per annum/quarter/month/week • m2 NFA p.a. / p.q./ p.m. / p.w. • m2 GFA p.a. / p.q./ p.m. / p.w. • m2 ITZA p.a. / p.q./ p.m. / p.w. • per unit p.a. / p.q./ p.m. / p.w. |

Recurrent non-recoverable operational costs | Read-only field that displays the sum of recurrent non-recoverable operational costs. |

Hardcore yield | Enter the hardcore yield for the contract (as a percentage). Can be entered in bulk. |

Reversionary yield | Enter the reversionary yield (as a percentage). Can be entered in bulk. |

Froth yield | Enter the froth yield (as a percentage). Can be entered in bulk. |

Discount rate | Enter the discount rate (as a percentage). Can be entered in bulk. |

Gross capital value before adjustments | This calculated read-only field displays the initial estimated capital value of the property before any specific adjustments are applied. You can select one of the following calculation methods: • per contract • m2 NFA / m2 GFA / m2 ITZA |

Relet corrections capitalization method | Here you can specify the method used to account for capital expenditures related to re-letting the property. You can choose from the following options: • None • Only initial • Initial & continuous |

Adjustments | This read-only field displays the total amount of adjustments (positive or negative) applied to the gross capital value. You can select one of the following calculation methods: • per contract • m2 NFA / m2 GFA / m2 ITZA |

Capital expenditures | This read-only field displays the total capital expenditures related to the property. |

Gross capital value | This calculated read-only field displays the gross capital value of the property. You can select one of the following calculation methods: • per contract • m2 NFA / m2 GFA / m2 ITZA |

Net capital value | This calculated read-only field displays the gross capital value of the property. You can select one of the following calculation methods: • per contract • m2 NFA / m2 GFA / m2 ITZA |