Financial commitments data fields

The fields for the functional currency have the prefix "FC" (only applies to contracts based on lease accounting). |

Field | Description | ||

|---|---|---|---|

Contract line | Displays the contract line to which the financial commitment applies. | ||

Closure date | Indicates the date on which amounts can be closed. This date depends on whether payment is in advance or in arrears. Example: A user has agreed that rent is to be paid monthly in advance. The commitment period is 1/1/2008 - 1/31/2008. In this case, the closure date is 1/1/2008. If the user agrees that the amount is to be paid in arrears, the closure date is 1/31/2008. | ||

Payment date | Displays the date at which the financial commitment is to be settled. | ||

Accounting date | Displays the accounting date and indicates the period the financial commitment is accounted for. Accounting dates refer to the actual dates that an accounting period begins and ends. The accounting date must be within an accounting commitment start date and end date. | ||

Start date commitment | Displays the start date of the financial commitment. | ||

End date commitment | Displays the end date of the financial commitment. | ||

Payment? | Indicates if the amount specified is to be paid to or received from the other party.

| ||

Amount (incl. / excl. tax) | The financial commitment amount in this field is calculated based on the values specified in the Amount, Amount per and Payment frequency fields of the corresponding contract line at the Contract details > Contract lines selection step. Example 1 Amount (contract line) = $ 1500 Amount per = month (monthly amount) Payment frequency: 3 months Amount financial commitment = $1500 * 3 = $ 4500 Example 2 Amount (contract line) = $ 12000 Amount per = year (annual amount) Payment frequency = 3 months Amount financial commitment = ($12000/12) * 3 = $ 3000 | ||

FC - amount excl. VAT | If you are using functional currencies in lease accounting contracts (see the Lease accounting documentation), this field displays the financial commitment amount based on the functional currency. | ||

FC - spot exchange rate | If you are using functional currencies in lease accounting contracts (see the Lease accounting documentation), this field displays the spot exchange rate that is used to calculate the functional currency. Planon uses the spot rate that was valid on the financial commitment's Payment date. | ||

VAT rate | Displays the VAT rate that applies to the financial commitment.

Example Amount (contract line) = $ 100 Amount per = month Payment frequency = 3 months VAT rate = 6% This results in the following financial commitment: 1/1/2010 – 3/31/2010: Amount incl. VAT = $ 318 (300 + 18,00 VAT based on 6% VAT) Assume the VAT tariff changes on 2/1/2010 from 6% to 19%. The following 2 financial commitments are created: 1/1/2010 – 1/31/2010 Amount incl. VAT = $ 106 (100 + 6,00 VAT based on 6% VAT) 2/1/2010 – 3/31/2010: Amount incl. VAT = $ 238 (200 + 38,00 VAT based on 19% VAT) | ||

Send to financial system? | Planon uses this field to indicate whether postings should be sent to your financial system. | ||

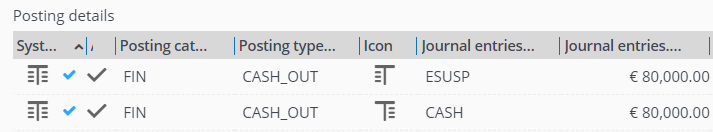

Posting details | Displays an overview of all relevant data of the postings/journal entries linked to the financial commitment.

| ||

Technical comment | This field can be used by exporting interfaces to store additional information about the export in addition to the Send to financial system field. Technical comments can include for example an export batch ID. This field is populated by Planon and cannot be changed by users. |