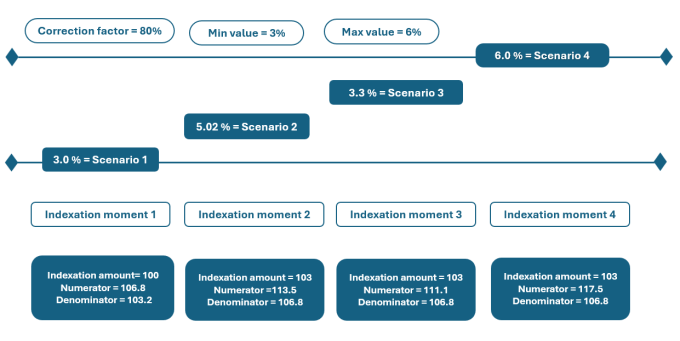

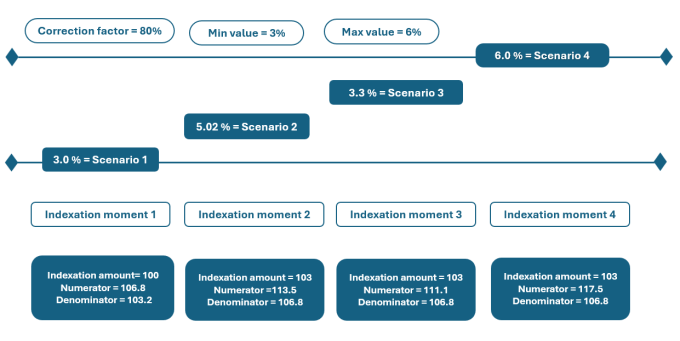

Using a correction factor

If you are using a base amount indexation method or an indexation based on index groups, you can also specify a correction factor on the indexation percentage in the appropriate field at the Contract details > Contract lines step.

The calculated indexation percentage will be multiplied by the correction factor. The result of this calculation is used to index the amount in the contract line.

The calculated indexation percentage will be multiplied by the correction factor. The result of this calculation is used to index the amount in the contract line.

Example

Scenario 1: The calculated indexation amount is 3.5. After the correction factor is applied, the indexation percentage is 2.8 (80% * 3.5 = 2.8). Comparing this number with indexation amount, the percentage lies below the minimum value, the amount on the contract line will be indexed by minimum value (=3%). As the correction factor is occurred because of minimum indexation is applied, for the future indexations the calculated new Amount (103) is taken as indexation amount and numerator of the current indexation (106.8) will be set as index number for future indexations.

Scenario 2: The calculated indexation amount is 6.4. After the correction factor is applied, the indexation percentage is 5.04 (80% * 6.4 = 5.02). Comparing this number with indexation amount, the percentage lies between the minimum value and maximum value, the amount on the contract line is indexed by 5.02% (80% * 6.4 = 5.02).

Scenario 3: The calculated indexation amount is 4.1. After the correction factor is applied, the indexation percentage is 3.3 (80% * 4.1 = 3.3). Comparing this number with indexation amount, the percentage lies above the minimum value, the amount on the contract line will be indexed by 3.3% (80% * 4.1 = 3.3).

Scenario 4: The calculated indexation amount is 10.3. After the correction factor is applied, the indexation percentage is 8.2 (80% * 10.3 = 8.0). Comparing this number with indexation amount, the percentage lies above the maximum value, the amount on the contract line will be indexed by maximum value (= 6%). As the correction factor is occurred because of maximum indexation is applied, for the future indexations.