Updating price and tax / VAT

You can update the order lines of Purchase orders, Standard (purchase) orders and Maintenance activity definitions (MADs) with the latest price and tax / VAT rates of a purchase item.

Only orders and purchase orders that start or end (Requested completion date) on/after the Price submitted on date, are updated with the latest changes. |

Procedure

1. On > , select a purchase item to update the price and tax / VAT rates.

2. In the data section, update the Standard amount and Tax / VAT tariff fields with the new values and enter the Price submitted on date.

3. Click Save.

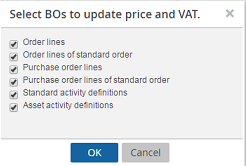

4. On the action panel, click Update price and tax / VAT. The Select BOs to update price and tax / VAT dialog box appears.

5. Select the business objects that require a price/tax/VAT update.

Click OK. The selected business objects are updated with the latest price and tax / VAT values.

6. The Event log displays the name of the purchase item and business objects that are updated/not updated.