Transferring a lease contract

Within a company, a lease can be transferred from a legal entity to another; from a department to another (a car can be transferred from ‘Sales’ to ‘Services’).

This transfer is not only about the accounting of the future payments and costs (hence booking the payment, interest and depreciation on a new cost center, a new legal entity) but also move the balance position of right-of-use asset and lease liability at the effective date of the transfer from one balance sheet to another.

To execute this transfer, use Execute Balance Sheet Transfer icon ( .

.

.

.Procedure

1. Go to Lease contracts (Lease accounting) > Contracts and select the active lease that needs to be transferred.

2. On the action panel, click Execute Balance Sheet Transfer.

The Enter values window appears. Enter the effective date of the transfer in the Date of Transfer field.

The effective date of the transfer is the date at which the lease begins to be accounted for by the new lessee. Example: the lease stops being accounted for the current lessee on 31 Dec. 2025, then start being accounted for by the new lessee on 01 Jan. 2025: the effective date of the transfer to be entered is ’01 Jan. 2025’. |

3. Click OK.

The process for the lease transfer is a merging of Onboarding and Copying, with a specific accounting event and the automatic process of the carrying values.

The current lease is stopped and its copy is created, both as per the Date of transfer.

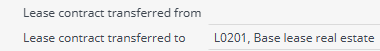

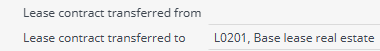

On the stopped lease, the copy is referenced as the Lease contract transferred to( ).

).

).

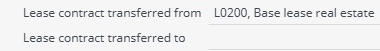

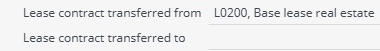

).On the new copy lease, the stopped lease is referenced as the Lease contract transferred from ( ).

).

).

).For reference, the current lease that has been stopped and transferred will be referred as Transferred to lease, and the new lease that has been created and transferred will be referred to as Transferred from lease.

The Transferred from lease lease contract and lease amount are not Terminated, but automatically shifted to Status Transferred.

Lease contract | Lease amount |

|---|---|

|  |

As a copied lease, the Transferred to lease comes with the limitations of a the copying process. For more information, see Copying contract lines.

The Transferred to lease lease contract and lease amount are in status In preparation or Inactive, like all new created lease.

Some fields are frozen with the originating values to avoid modifications that are not supported:

◦ Payment

◦ Payment in advance

◦ Apportionment calculation method

◦ Payment patterns start date

◦ Start of regular payment

◦ Postponed payment date

The rest of the fields are then available and can be modified when needed. (Accepting contracting party, Financial reporting entity, Cost center all the descriptive data involved in the transfer.)

On the other hand, even open for modification, fields that are related to the calculation of the lease liability should not be modified before the Transferred to lease is activated. Some example of the fields related to calculation: Amount, Reasonably certain to be applied, New rent at renewal, Guaranteed residual value, Purchase price. If they are modified, the consequent remeasurement will be booked without any Financial event registration to identify which modification have been performed. It’s then recommended to activate the ‘transferred to lease’ with the exact lease payments and lease term that has been transferred, then perform any lease modification that will be registered properly. |

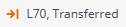

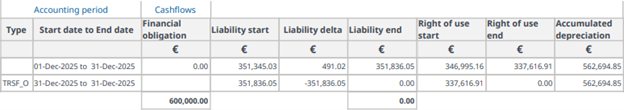

On the Transferred from lease, an accounting commitment of type TRSF_O, Transfer out derecognizes the carrying values.

On the Transferred to lease, an Accounting commitment of type ‘TRSF_I, Transfer in’ recognizes the same carrying values.

A subsequent accounting commitment of type I, Initial is present to catch up between the transferred carrying value of lease liability and the net present value of forecasted lease payments on the Transferred to lease in case they differ from the Transferred from lease.

Important | • Impaired leases • Restoration costs • ASC 842 Operating leases • Accrued balance payment from expensed leases (straight-lined expenses over lease term or payment term) • Head and subleases |