Registering a sale and leaseback transaction

If you sell an asset and lease it back from the purchaser, you can register a sale and leaseback transaction in Planon. In such an agreement, you become the lesseeof the asset you formerly owned. For a sale and leaseback transaction, you must specify the sales price, the carrying amount and the fair value of the asset.

The lease starts with a calculation of the lease liability and right-of-use. The sale and leaseback transaction leads to a correction of the liability and right-of-use, if applicable. Calculation results are shown in the Sale and leaseback commitment.

Procedure

1. At the Contracts selection level, select the contract for which you want to register a sale and leaseback transaction.

2. Go to > .

3. Select the required lease contract line.

4. Set the Sale and leaseback? field to Yes.

If set to Yes, you must specify a value in the following fields: Sales price, Fair value and Carrying value for 'Sale and leaseback'.

The financial processing of the sale and leaseback is determined by the height of the sales price compared to the fair value:

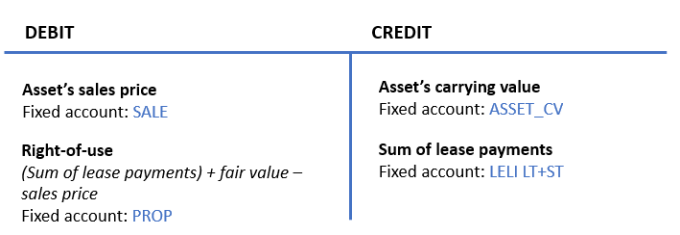

◦ If the sales price you specified is lower than or equal to the asset's fair value:

Planon calculates the right-of-use: (lease payments) + fair value - sales price

The following posting is created:

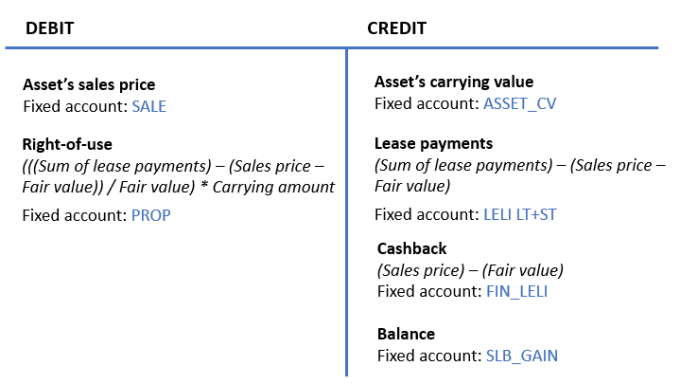

◦ If the sales price you specified is higher than the asset's fair value:

On the lease contract line, an amount is calculated and registered that is partly the lease amount (104,261 in the example below) and partly the financing amount (120,000 - 104,261 = 15,739 in the example below). This amount is registered as a cashback in the accounting commitments. The cashback is used for partial financing of the lease payments. The initial cashback (FIN_LELI) is registered in the Sale and leaseback commitment posting:

Sales price exceeds fair value - example

◦ Sales price = 2,000,000

◦ Carrying value asset = 1,000,000

◦ Fair value = 1,800,000

◦ Lease amount = 120,000 (per year, paid in advance, annual payments)

◦ Discount rate = 4.5% (per year)

◦ Lease term = 18 years

Calculations are based on the following formulas:

Variable | Formula |

|---|---|

Lease amount, excl. financing part | Lease amount payable * Sale & Leaseback factor |

Sale & Leaseback factor | Lease liability, corrected / Lease liability, based on lease amount payable |

Lease liability, based on lease amount payable | Sum of payments for the lease |

Lease liability, corrected | Lease liability, based on lease amount payable - Cashback |

Cashback | Sales price asset - Fair value asset |

With the data from the example, this results in the following calculations and values:

Variable | Calculation | Value |

|---|---|---|

Lease amount, excl. financing part | 120,000 * 86.9% | 104,261 |

Sale & Leaseback factor | 1,324,863 / 1,524,863 | 86.9% |

Lease liability, based on lease amount payable | 18 * 120,000 | 1,524,863 |

Lease liability, corrected | 1,524,863 - 200,000 | 1,324,863 |

Cashback | 2,000,000 - 1,800,000 | 200,000 |