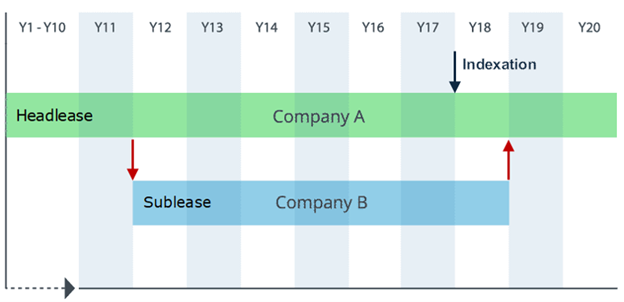

Indexing a headlease

This process only applies when the headlease and the sublease are both classified as a Financial lease.

During a sublease, when the headlease amount is indexed, not all the proportional part of the right-of-use asset that is derecognized on behalf of the sublease is reflected in the Unguaranteed residual value of the sublease. A second proportional calculation is applied on the amount of right-of-use asset that is derecognized, based on the ratio between the remaining term of the sublease and the remaining term of the headlease.

The proportional part related to the remaining term of the headlease after the sublease ends is registered on the Unguaranteed residual value of the sublease, the difference is directly registered as gain/loss (GALO).

Example: an indexation is applied on the headlease at the beginning of year 18. It’s 3 years before the end of the headlease, and 1 year before the end of the sublease.2/3 of the remaining term of the headlease is not subleased.

For 150 of right-of-use assets that is derecognized from the headlease, 50 is booked as a gain/loss and 100 becomes part of the