Predefined changes at inception of lease

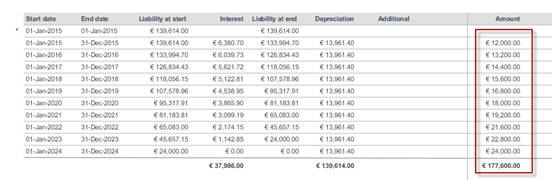

In this example, the finance lease contract period is 10 years. The amount is 12,000 euros every year appraised with a fixed amount of 1,200; payment at the end of the year, given an interest rate of 5%.

Condition: The predefined price changes need to be defined before activation of the contract line. It is also possible to define the contract line based on an indexation based on percentage. The indexation will be applied at activation of the contract line and the initial calculations are based on the indexed amounts.

The total liability: The total liability at the start of the lease period is calculated as the sum of amounts to be paid, taking the interest of 5 % into account. Given an annual amount of 12,000.00 and interest rate of 5 % and given the fixed raise of 1,200.00 each year. The net present value takes all changes known at the inception of the lease that are incorporated into the calculation of minimum lease payments.

Residual value:

In this example, the finance lease contract period is 10 years. The amount is 1,000.00 euros each year, payment at the end of the year, given an interest rate of 5%. At end of the lease there is an agreement to have 1,500.00 euro as a residual value.

Condition: The residual value needs be entered before activation of the lease contract line so that it can be included in the calculations.

Lessee perspective -Takes the guaranteed residual value into account.

Lessor perspective -Takes the highest of the unguaranteed and the guaranteed value

Liability at start: Liability at the start of the lease period is calculated as the sum of amounts to be paid taking the interest of 5 % into account but also taking into account the residual value at end of 10 years. In this case, the present value of residual value of 1,500.00 euro at the start and given a rate of 5 %, the liability at the start will be 7,721.73 + 920.87 (which is 15,000.00 * 0,614) = 8642.60.

Liability at end: At the end of the contract duration, the liability will not become zero as it does in the base case. It will be 1,500.00 euro.