Finance lease base case

In this example, the finance lease contract period is 10 years. The amount is 1,000 euros each year, payment at the end of the year, given an interest rate of 5%.

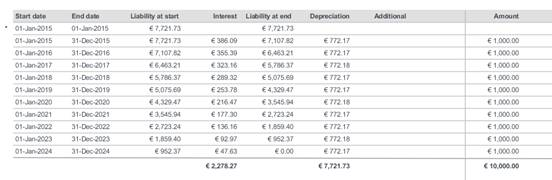

The finance lease calculations start with a data record that begins and ends on the start date of the contract line and contains the total minimum lease payments at start of the lease. In this case it is 7,721.73 euros.

The total liability: The total liability at start of the lease period is calculated as the sum of amounts to be paid taking the interest of 5 % into account. The setting on the contract line for payments at the start or at the end of the period is taken into account in these calculations. For example, given an annual amount of 1,000.00 and a rate of 5 %:

Period | Payment before | Payment after |

|---|---|---|

Year1 | 1,000.00 | 952.38 |

Year2 | 952.38 | 907.03 |

Year3 | 907.03 | 863.84 |

Liability at start of the period: This is equal to the liability at the end of the previous period and represents the liability on the first day of the accounting period.

Interest: Based on the liability at start of the period and depending on registered payments in this accounting period, the interest is calculated based on the current liability. In case of a payment at the end of the period, the interest is calculated based on a liability of 7,721.73 euro. So 5% of this amount will be booked as interest.

Liability at end: The remaining part (1,000.00 – 386.09) = 613.91 euro will be spent on reducing the liability, so the liability at the end is 7,107.82 = 7,721.73 + 386.09 – 10,000.00.

Depreciation: Is calculated as a linear depreciation, the total liability should be depreciated to the residual value at the end of the contract line period at the end of the lease (0 euro in this case). Depreciation will only be calculated for the lessee and only if the contract line setting depreciate property= Y.