Case with payment period > accounting period

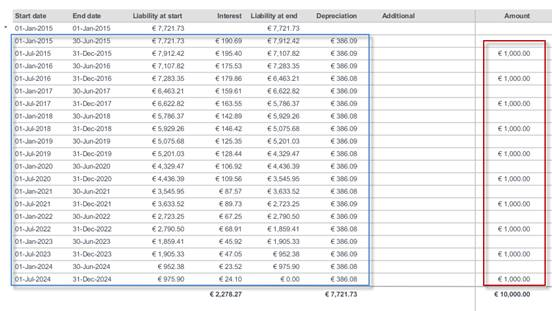

In this example, the finance lease contract period is 10 years. The amount is 1,000.00 euros each year, payment at the end of the year, given an interest rate of 5%. The accounting period is every half year.

In this case the total of minimum lease payments is not different from the base case, the payments did not change in this case. The accounting periods are split into two separate periods, so the interest, the liability at the end of the period and the depreciation is different.

Interest: If the interest of the first two periods is added: 190.69 + 195.40 = 386.09 euro, just as our based case.

Liability at the end of the second period (= one year) is also the same as in the base case: 7,107.82.

Depreciation: It is spread out over two periods and adding two periods will have the same amount as in the base case: 386.09 + 386.09 = 772.17 (notice that there is a difference due to rounding).