Use case

A customer with offices in the US and headquartered in the EU is using various currencies.

Its US offices use USD, internal reporting is done in EUR:

• Contract currency = USD

• Functional currency = EUR

US contracts for this customer are registered in USD. Amounts for these contracts are converted using the specified currency exchange rates. These converted amounts are displayed on the contract’s accounting commitments in two currencies: USD and EUR. To take into account exchange rates, customers must regularly update the spot rates for their currency pairs (in this example: USD-EUR).

Journal entries & accounting commitments

Accounting commitments

Amounts on the accounting commitments are automatically registered in both currencies. The contract currency is leading, the functional currency is mapped to the latest exchange rate. At trial closure a recalculation takes place based on the latest exchange rate.

Journal entries

When a contract line is made active, calculations based on the contract currency are mapped to the functional currency. During the contract’s duration, amounts are recalculated based on the current exchange rates when a trial closure is performed. In the following image, this happens monthly.

Interest

Typically, interest is paid over a certain period of time. On the contract line, the interest is registered in the contract currency (USD). During a trial closure, the interest amount is mapped to the functional currency (in EUR) using the average exchange rate over that period of time.

Liability in functional currency

The Liability at start and Liability at end on a contract is mapped to the functional currency by using the spot rate.

• The first Liability at start is calculated when the contact is made active.

• The Liability at end is calculated at month end. The subsequent Liability at start is not calculated but takes over this value.

Net movement is the difference between the Liability at startand the Liability at end. It is calculated by subtracting the Interest (calculated by using the average exchange rate) from the Payment (calculated by using the spot rate):

Net movement = Payment – Interest

Because these fields are calculated using different exchange rates, it results in a difference that must be accounted for and which – on the accounting commitments – is booked as Forex – gain / loss.

Right of use in functional currency

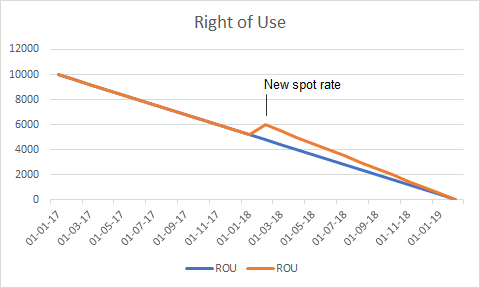

At the start of a contract (using the contract currency), the right of use (ROU) is once calculated by using the functional currency based on the spot rate. The ROU is then calculated up to the contract end date, which can be represented in a slope diagram as follows (blue graph):

Whenever there is a financial event that affects your ROU, the ROU can be recalculated using the current spot rate. The new ROU will again be straightlined until the end of the contract (orange line).