Straight-lining lease payments

In accounting, straight-line accounting methods provide a means to evenly distribute costs and revenues over a fixed length of time. In Planon, payment periods can be monthly, quarterly, weekly, semi-annual or annual whereas accounting periods are monthly or weekly. The Straight-line payments? field on the contract line allows you to specify whether lease payments that cover more than one accounting period must be straight-lined to the same frequency as accounting periods (monthly or weekly). For more information about this setting, see Contract line fields for lease accounting.

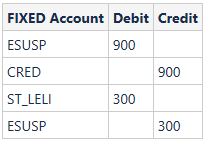

When straight-lining payments, the full lease payment is debited to the SUSPENSE account (lessee) and credited to CRED. In case of monthly accounting periods, the amount for that month is debited to LIABILITY and credited to SUSPENSE.

There are two types of SUSPENSE accounts: ESUSP for lessee (suspense account - expense) and ISUSP for lessor (suspense account - income). |

Example:

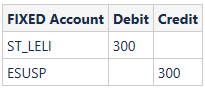

Quarterly rent payment is €900, received in the first month. The monthly rent amount is €300. Based on this data, Planon generates the following postings:

First month:

Second and third month:

For an overview of the fixed ledger account codes as defined by Planon, see Overview of fixed ledger account codes. |