Amount changes in a financially closed period

For amount changes in a financially closed period, Planon generates supplements. Supplements are an addition to a financial commitment. Normally, a supplement will have the first day in the first open period as a due payment date. This date is also used to determine the accounting period, so the 'accounting date' will also be set to the first day in the first open period. Planon considers a period to be closed based on:

• the Closure date of latest financial period in the financial year (that is adopted in the contract at the moment the contract is activated)

• the Closed until date - fin and Closed until date - Acct on the contract

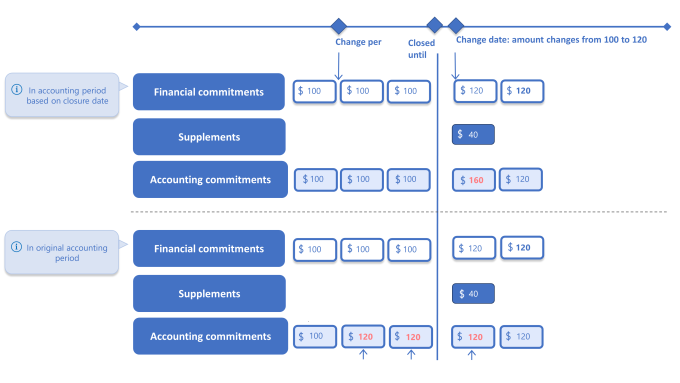

From an accounting perspective, there are two ways in which supplements are taken into account for calculations:

• in the accounting period based on the closure date of the supplement

• in the accounting period they originally belong to (retrospectively)

The calculation for each method is different. For the second method, the amount changes are taken into account in its corresponding period. Some companies have a policy of retrospectively taking into account the amounts. Sometimes contracts are registered after the closure date but accounted for as if they were registered in time. The impact of registering payments afterwards can be determined through the Take retrospective payments into account? setting. Setting this option to Yes ensures that the retrospective payments are included for accounting calculations in the original period, if a contract is entered or changed retrospectively. Default setting is Yes. This setting is available in Field definer and on the lease contract line.

1. If you want to set this on a company level for all contracts, use the Take retrospective payments into account? setting in Field definer . For more information, see Contract settings.

2. If you want to set this for a specific contract line, use the Take retrospective payments into account? setting on the contract line (see Contract line fields for lease accounting).

The setting on the contract line is taken over from the Contract settings in Field definer and can be changed as long as the contract line has not yet generated any supplements. Planon does not support a mix of both methods, it only supports one way of calculating. |

If Take retrospective payments into account? is set to Yes, the payment date of the supplement is calculated based on the payment date of the original financial commitment. See the example below.

Example:

• Without closure:

The result of activation of the lease or an amount change: the commitment of January 2020 has payment date December 15, 2019

• After closure of January 2020 and with the option Take retrospective payments into account? set to Yes (in a closed period):

The result of activation of the lease or an amount change: the supplement of January 2020 has payment date December 15, 2019