Cost settlement profile line fields

Field | Description | ||

|---|---|---|---|

Code | Enter the code of the cost settlement profile line. | ||

Name | Enter the name of the cost settlement profile line. | ||

Cost settlement profile | Select the cost settlement profile to which you want to link the cost settlement profile line. | ||

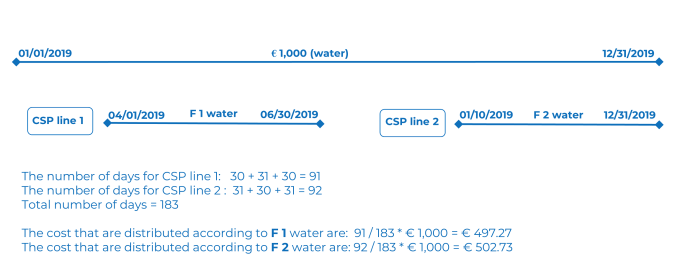

Start date / End date | Enter the start date and end date of the cost settlement profile line. The costs are distributed in the period between the start date and the end date. The different CSP lines do not have to be contiguous, but an overlap of CSP lines with the same cost type is not allowed.

| ||

Chargeable? | Specify if the costs must be allocated to the lessees. The default value is Yes, because in most cases the costs must be allocated to lessees. If Chargeable? = Yes, the costs are chargeable to the lessee, but the lessee must have a contract. If the value is No, the cost distribution is calculated, but all costs will be allocated to the lessor at the end. | ||

Charge costs to lessor at vacancy | Set this field to No to charge costs to lessees in case of vacancy. An example where this could be applied is a CSP line for the 'waste' cost type. If a space is empty, no waste is produced by the owner. The other lessees must therefore pay the waste costs. For such a CSP line you would set the value of this field to No (no charge to lessor). If you want to charge costs to the lessor, but with a reduced ratio, you could choose to set the value of the Space dimensions correction factor field to 0.1 in the vacancy period. The lessor then only participates in the cost distribution for 10% of the original ratio (for example on the basis of m2). | ||

Contract line group | Specify the required contract line group. Contract line groups are used to register costs that are paid in advance by the lessees (prepayments). You only complete this field if your organization has also broken down the prepayments per cost type (an advance amount for gas, a separate amount for electricity, etc.). Cost settlement is done per contract and all prepayments are combined, but you can view the prepayment amounts per cost type in the Cost settlement results. This gives your organization information about which lessees have paid too high or too low amounts per cost type. | ||

Cost type | Enter the cost type that you want to link to the profile line, for example 'Cleaning', 'Heating', 'Water', etc. | ||

Formula 1 | Select the required formula for dividing the costs. You can select one of the formulas from the formula library. The formula is only valid between the start and end date of the profile line. If you want to change the formula over time, you must create a new profile line with a new start and end date. | ||

Share (%) from formula 1 | Enter the percentage for which the formula should be applied. Example: 70% of the heating costs will be divided based on meter readings, whereas 30% will be split based on the m3 of the rentable unit. Default setting of this field is 100%. Share (%) from formula 1 and Share (%) from formula 2 together must be 100%. | ||

Formula 2 | If you want to use a second formula, you can select one of the formulas from the formula library. | ||

Share (%) from formula 2 | Enter the percentage for which the formula should be applied. By default this field is empty. Share (%) from formula 1 and Share (%) from formula 2 together must be 100%. | ||

Lessor | Select the lessor that has to pay the percentage specified in the Lessor's % of amount field. | ||

Lessor's % of amount | Enter the percentage that must be paid directly by the lessor of the space. | ||

Administration costs % | Enter the percentage that you want to charge as administration costs. Within the CSP line, administration costs are only calculated for the lessee part and not for the lessor part. | ||

VAT administration costs | Enter the VAT percentage that applies to the administration costs. | ||

Comments | Enter additional information if necessary. |