Invoice line fields

Field | Description | ||

|---|---|---|---|

Code | Enter the code of the invoice line. | ||

Name | Enter the name of the invoice line. | ||

Invoice | Select the invoice to which you want to link the invoice line. | ||

Invoice date | Select the invoice date. | ||

Start date of cost period / End date of cost period | Enter the date that marks the start /the end of the invoice period.

| ||

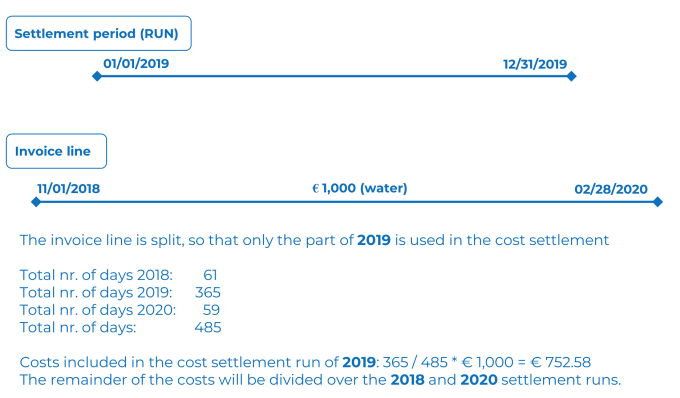

Status | This read-only field displays the status that is assigned to the invoice line: In preparation, Settled or Partially settled. The Partially settled status is used in situations as described in the previous example. | ||

Cost type | Select the cost type on which the costs of the invoice line must be registered. | ||

Cost settlement profile | Enter the cost settlement profile to which you want to link the invoice line. | ||

Total costs excl. VAT | Enter the total amount of the invoice line excluding VAT. | ||

Total VAT costs | Enter the total VAT amount of the invoice line. | ||

Total costs incl. VAT | Displays the total amount of the invoice line including VAT. This amount is calculated automatically, after completing the fields Total costs excl. VAT and Total VAT costs. | ||

Lessor | Enter the lessor who pays the part of the invoice (line) as specified in the Lessor's % of amount or Amount for lessor field. If you want to allocate part of the invoice line costs directly to the lessor, you must enter this field. In all other cases you can leave it empty. | ||

Lessor's % of amount | Enter the percentage that must be paid directly by the lessor. If you rather specify a specific amount, enter an amount in the Amount for lessor field. | ||

Amount for lessor | Enter the amount (excl. VAT) that must be paid directly by the lessor. If you rather specify a percentage, enter a percentage in the Lessor's % of amount field. | ||

VAT amount for lessor | Enter the VAT amount that has to be paid by the lessor. | ||

Contract | Select the contract for the assignment of costs. If you specify the Lessee's % of amount or Amount for lessee field, the costs are directly assigned to the accepting party of this contract. | ||

Lessee's % of amount | Enter the percentage that must be paid directly by the lessee. If you rather specify a specific amount, enter an amount in the Amount for lessee field. | ||

Amount for lessee | Enter the amount (excl. VAT) that must be paid directly by the lessee. If you rather specify a percentage, enter a percentage in the Lessee's % of amount field. | ||

VAT amount - lessee | Enter the VAT amount that has to be paid by the lessee. | ||

External contractor | If relevant, select an external party hired by either the lessor or a contracting party (for example the costs charged by this external contractor are included in the total invoice costs). There is no further functionality behind this field. | ||

Order costs | Displays the order costs registered in Work Orders . | ||

Financial commitments | Displays the financial commitments of costs arising from service contracts / lease contracts registered in Contracts . This field is only (automatically) populated when you have imported the costs from service contracts / lease contracts. |