Financial overview

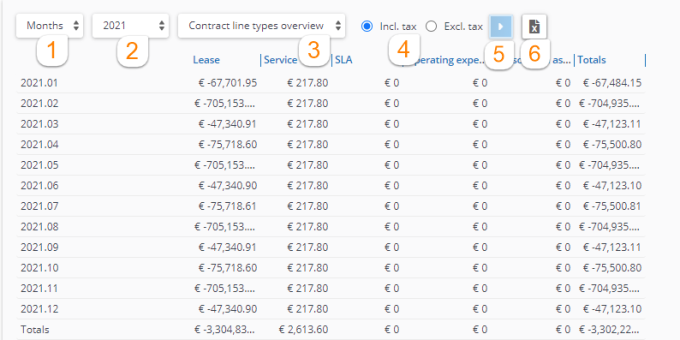

A tabular overview of financial commitments is displayed by clicking the Financial overview button at the selection step. The data in this overview is not displayed by default when you navigate to the Financial commitments step. Use the Show data button to display the data. Each time you change a setting, you must generate the overview again.

1 | Financial commitments can be shown per year / quarter / month / week. If indicated in the contract settings (see Contract settings), you can also show financial commitments per English / (Old) Scottish / Irish years, English / (Old) Scottish / Irish quarters. | ||||

2 | Select the year for which you want to display financial commitments. You can choose between All years and Current year. After you have generated the overview, all other years will become available as options in this drop-down list. | ||||

3 | Financial commitments can be displayed in different views. Select from: • Contract line types overview - financial commitments are grouped by contract line type: Lease, Service and SLA. • Overview including payments - This view can be used by customers using Cashflow . It provides a clearer overview of financial data than the financial commitments list view. The financial commitments are grouped by commitments, cashflow and balance.

• Contract lines overview - financial commitments are grouped by contract line. • Contract line groups overview - financial commitments are grouped by contract line group.

| ||||

4 | Select if the financial commitments displayed must include tax or exclude tax. By default, the displayed values are always including tax. | ||||

5 | Use the Show data button to display the data in the overview. Each time you change a setting, you must generate the overview again. | ||||

6 | Financial commitments can be exported to Microsoft Excel using the Export button. |

Selecting a cell in the financial overview displays a pop-up with a detailed overview of the relevant month or week. This pop-up also includes an Export button for Microsoft Excel.

The official start day of the week is determined by the language in which you use in Planon ProCenter . If you use US English, a week starts on Sunday and ends on Saturday. For other languages, a week can begin on Monday and end on Sunday. This is why the data shown in the Financial overview can differ per user language.

When drilling down directly from the Properties level to the Financial overview step, not all the contracts may be displayed since the reference date is taken into account. To display all contracts, go to Properties > Contracts level and click Deactivate reference date on the toolbar, and then proceed to the Financial overview step.

In Field definer > > y ou can specify how amounts of the type 'Pay' and 'Receipt' should be displayed in the Financial overview. For both types of amounts, you can specify if they should be shown as positive (+) or negative (-). For more information on this, see the Field definer documentation. |

Interpreting values

The sign prefixing the commitments in the overview indicate whether money is paid or received. For an explanation of the meaning of these signs, please refer to following table. The explanation in this table is based on the default display settings as defined in Field definer > > .

Contract line type | Sign | Meaning |

|---|---|---|

Payment | positive | Cash in (receipt) |

negative | Cash out (payment) | |

Receipt | Positive | Cash in (receipt) |

negative | Cash out (payment) |

Interpreting values – example

The following examples explain how to interpret the data in the Overview including payments view.

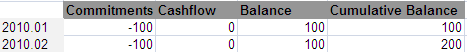

Example 1

• Payment (defined on contract line)

• No cashflow start balance

• Cashflow start date = 01 January 2010

An amount of 100 is required to be paid on 2010.01, no cashflow is registered (nothing is paid), hence the balance and cumulative balance (money to be paid) is 100.

On 2010.02, again an amount of 100 is to be paid. No cashflow is registered, so the balance for the line is 100 (to be paid). Now, the cumulative balance is 200 (adding up the previous cumulative balance and the current balance).

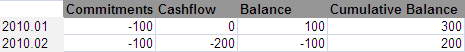

Example 2

• Payment (defined on contract line)

• Cashflow start balance = 200 (to be paid – no money is registered in Planon ProCenter yet)

• Cashflow start date = 01 January 2010

On 2010.01, 100 is due, no cashflow is registered (nothing is paid), so the balance is 100 (debit). The cumulative balance is 200 (cashflow start balance) + current balance = 300.

On 2010.02, 100 is due. 200 is paid, so the balance for this month is -100 (credit). The cumulative balance is 300 – 100 = 200.

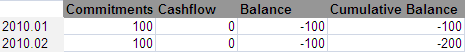

Example 3

• Receipt (defined on contract line)

• No cashflow start balance

• Cashflow start date = 01 January 2010

On 2010.01, 100 is due to be received. No cashflow is registered (nothing is paid), so the balance is -100 (credit), and the cumulative balance is -100.

On 2010.02, again 100 is due to be received. No cashflow is registered, so the balance for that month is -100. The cumulative balance is -100 + -100 = -200 (credit).

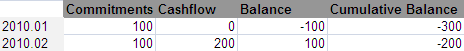

Example 4

• Receipt (defined on contract line)

• Cashflow start balance = -200 (to be received)

• Cashflow start date = 01 January 2010

On 2010.01, 100 is due to be received, but no cashflow was registered. Consequently, the balance is -100 (credit). Taking into account the cashflow start balance of -200, this brings the cumulative balance to ‑300.

On 2010.02, again 100 is due to be received, and 200 is paid. The balance for that month is 200 (paid) -100 (due) =100. The cumulative balance is -300 + 100 = -200.

For a correct and complete overview we recommend not to filter out any data as this may render an incorrect view. |

You can pay money against contract commitments via invoices or via cashflow. For more information, see Invoices or Cashflow . |